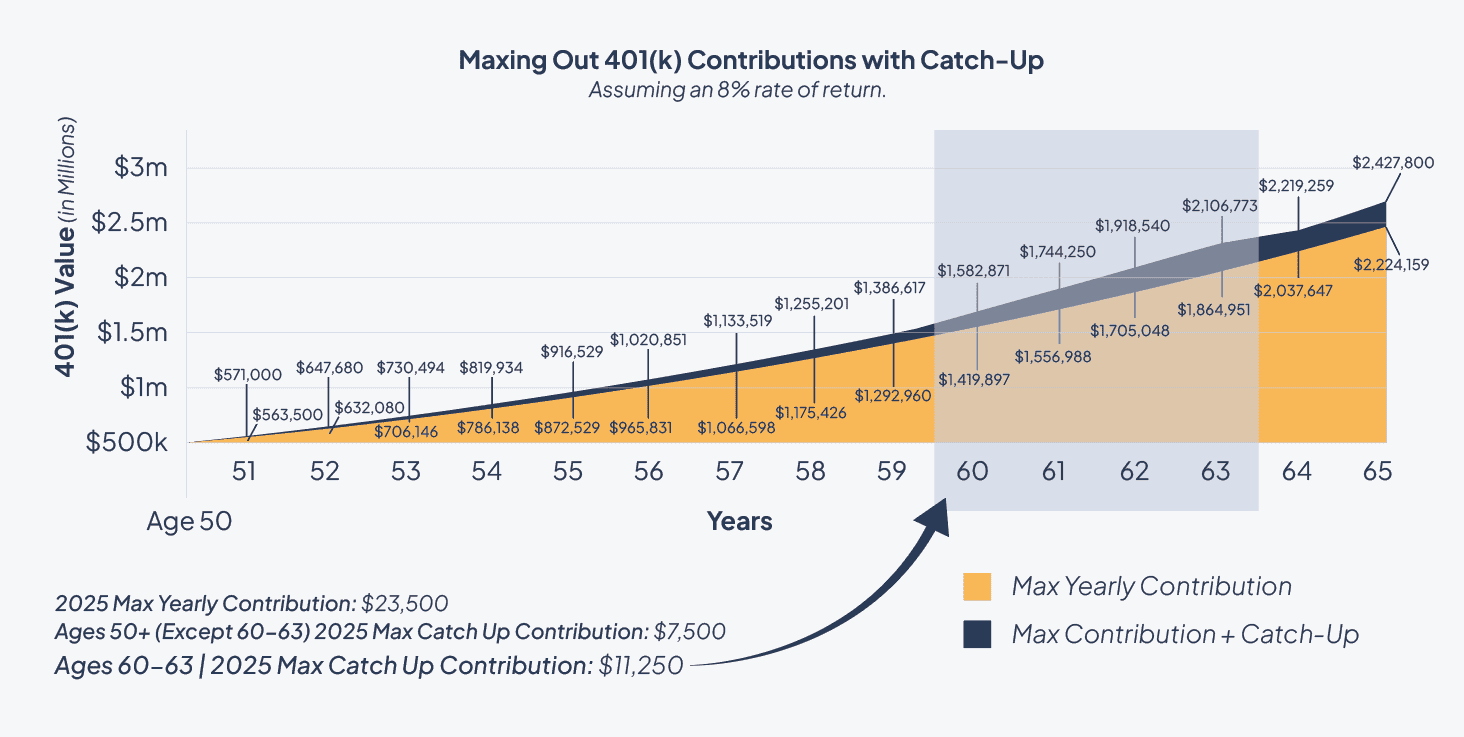

Yearly 401k Contribution Limit Catch Up 2025

BlogYearly 401k Contribution Limit Catch Up 2025. Starting in 2025, employees can contribute up to $23,500 into their 401 (k) and 403 (b) plans, most 457 plans, and the thrift savings plan for federal employees, the irs announced nov. That means an active participant 50 or older can contribute up.

The annual contribution limit for iras will remain at $7,000 for 2025. Eligible taxpayers may contribute up to $23,500 to their 401 (k) plan during the year.

401k 2025 Catch Up Contribution Limit Irs Tamra Florance, Key points about the 2025 401 (k) contribution limits:

401k 2025 Contribution Catch Up Limit Irs Andrew Nash, Employee's contribution limit according to reports, employees' epf contribution cap will be eliminated.

2025 401(k) and IRA Contribution Limits Modern Wealth Management, This limit is an increase from.

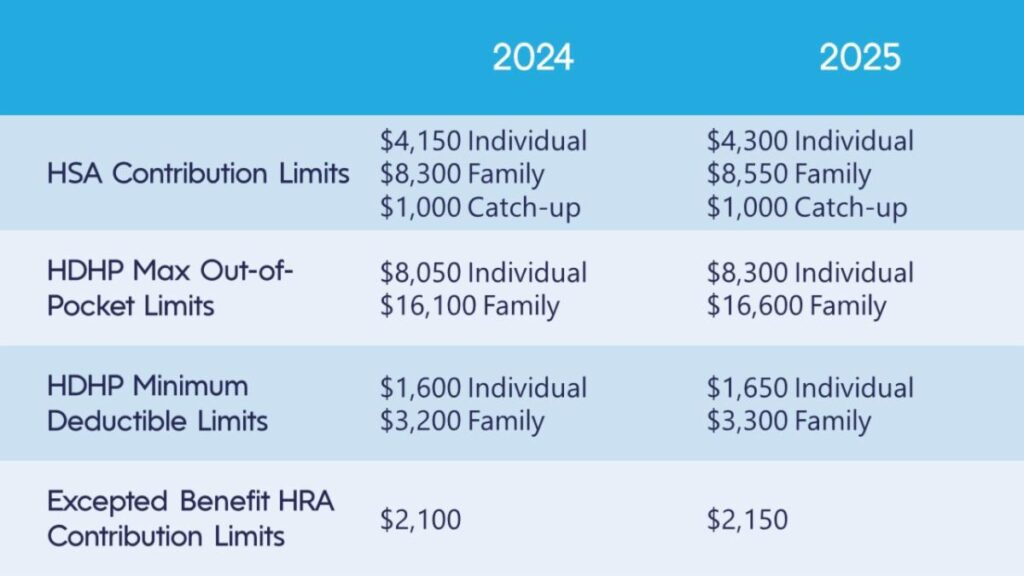

Irs 401k Limit 2025 Catch Up Michael Bailey, Below is a chart that outlines updated employee benefit.

401k Catch Up 2025 Contribution Limit Irs Delly Fayette, That means an active participant 50 or older can contribute up.

2025 Hsa Catch Up Contribution Limits Jorie Malinda, In particular, participants can now elect to defer up to $23,500 to 401(k), 403(b), and 457(b) plans in 2025 compared to $23,000 in 2025.

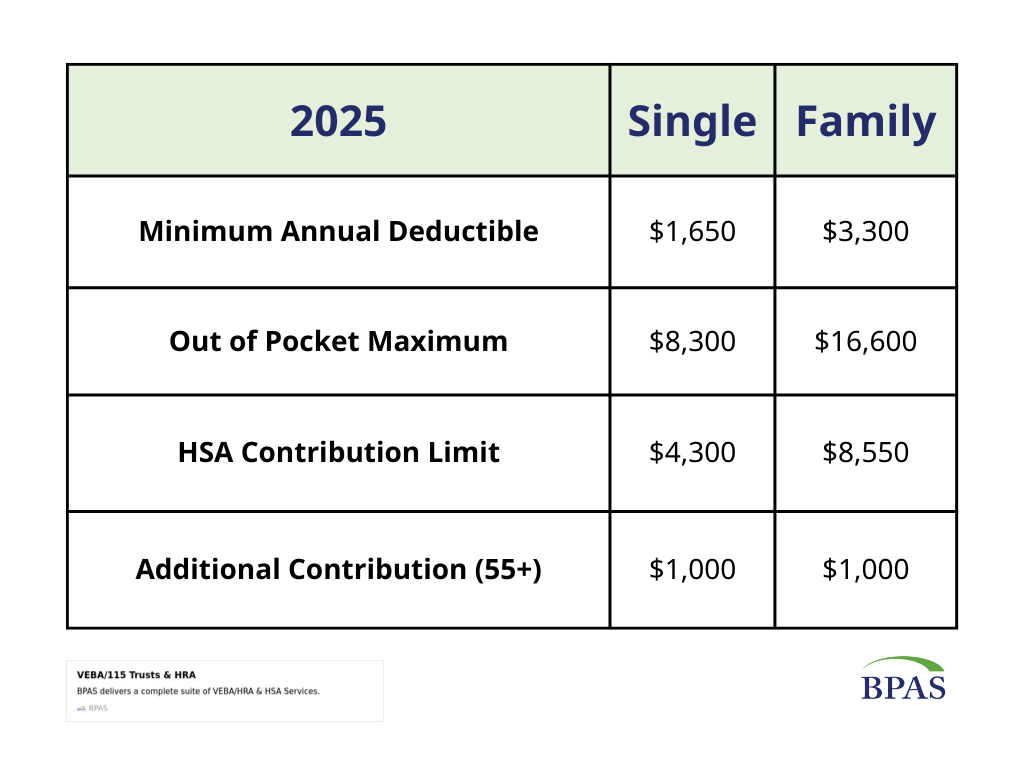

Updated HSA Contribution Limits for 2025 BPAS, At the moment, workers fund the epf account each month with 12% of their.

Maximum 401k Catch Up Contribution 2025 Fawnia Christye, The contribution limit has increased to $23,500 in 2025, up from $23,000 in 2025.

2025 401k Limits Catch Up Irs Jemima Rickie, The employee contribution limit increases modestly from $23,000 to $23,500.